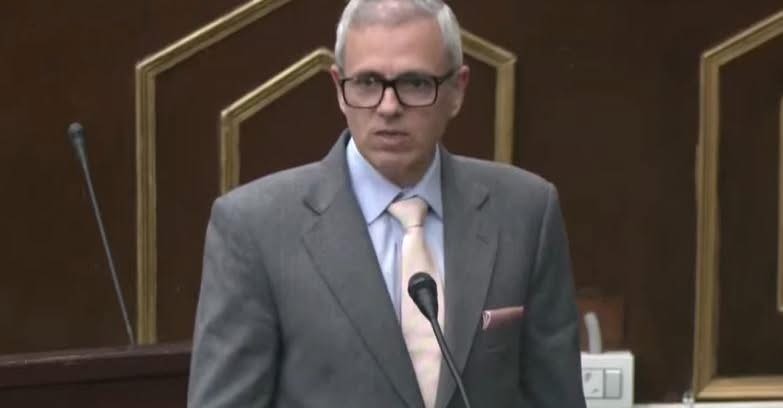

Drugs Worth Crores Seized In Baramulla Destroyed

SRINAGAR, Dec 30: On Saturday, the Jammu and Kashmir Police demolished a significant amount of illicit material valued at crores of rupees that had been found in the Baramulla district of North Kashmir. Under the direction of Senior Superintendent of Police Baramulla Amod Nagpure, the District Level Drug Disposal Committee Baramulla carried out the exercise. According to a police spokesman, the illegal substances that were taken from 27 cases at Police Station Uri, Boniyar, Pattan, Kreeri, Kunzer, and Tangmarg in the Baramulla district were destroyed at Pulwama.He stated that the items found in the confiscation weighed crores and included 6.303 kg of heroin, 63.413 kg of poppy straw, 207 kg of ganja, 652 kg of cannabis, 600 kg of cannabis powder, 3.950 kg of bang bosa, 953 kg of charas, 1.120 kg of charas powder, and 127 kg of fukki. In the presence of a committee that was appointed and led by the Deputy SP DAR Baramulla, the DySP ANTF Kashmir, the DySP CID CI Pulwama, the Executive Magistrate Kunzer, the Reader to the SSP Baramulla, the Field Inspector of the Pollution Control Board, and other district police officers, the seized drugs were destroyed at the Kashmir Health Care System, Lassipora Pulwama.It is important to note that Baramulla Police destroyed 32 cases of illegal substances that were seized from various police stations in the district in July 2023. Worth crores, the destroyed illicit materials included 6.376 grammes of charas, 32.900 kilogrammes of poppy straw, 14.289 kilogrammes of heroin, and 18 grammes of brown dugar. During the exercise, the locals met with the officers and expressed their gratitude for their dedication, professionalism, and hard work towards creating a drug-free society, according to the spokesman. [caption id="attachment_8032" align="alignnone" width="300"] Drugs Worth Crores Seized In Baramulla Destroyed[/caption]